Separate Money from State

Why bitcoin is the ideal tool for separation of money and state.

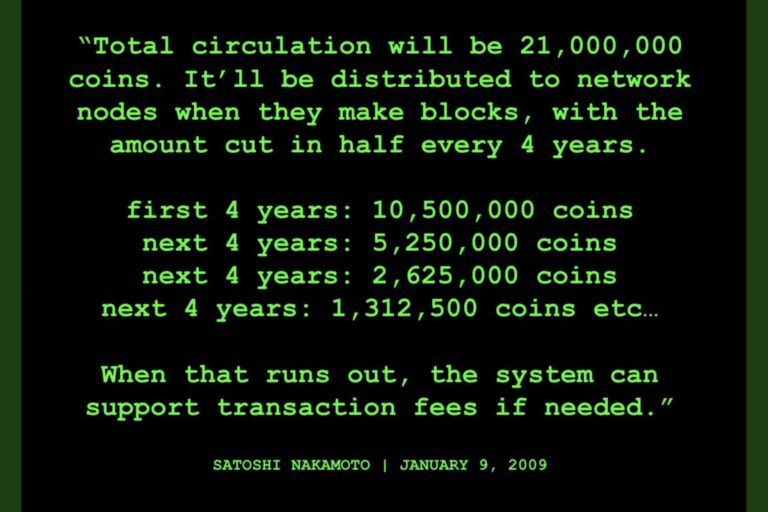

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. This means that it is not controlled by any government or financial institution. Instead, it is underpinned by a complex network of computers that work together to validate and record transactions on a public ledger called the blockchain.

One of the key features of bitcoin is that it is completely independent of any central authority, making it resistant to censorship and manipulation. This is why some people see it as an ideal tool for separating money from the state.

Since bitcoin is decentralized, it is not subject to the same regulatory oversight as traditional financial institutions. This means that users are able to send and receive payments without the need for intermediaries like banks. This makes it possible for individuals to have more control over their own financial affairs and to conduct transactions without the need for government approval or oversight.

In addition, the use of bitcoin allows for greater privacy and anonymity compared to traditional financial systems. Transactions on the blockchain are recorded publicly, but the identity of the users involved is not disclosed. This makes it a useful tool for people who value their privacy and wish to avoid having their financial activities monitored by the government or other third parties.

Overall, the decentralization and independence of bitcoin make it an appealing option for those who want to separate money from the state and take greater control over their own financial affairs.

Start your journey into self sovereignty by discovering one of the Bitcoin Lighting wallets such as The Wallet of Satoshi or Muun Wallet at your app store. Once installed join the Bitcoin Nottingham Telegram Group and we’ll send you 100 satoshi to start experimenting with!