Inflation is Theft

Why Inflation is Theft and Bitcoin is Number Go Up Technology, according to the AI!

BN: Explain why inflation is theft and how bitcoin fixes this because it is programmed to be deflationary.

AI: Inflation can be considered a form of theft because it erodes the purchasing power of money over time. As the supply of money increases, each unit of currency becomes worth less, which means that the same amount of money can buy fewer goods and services.

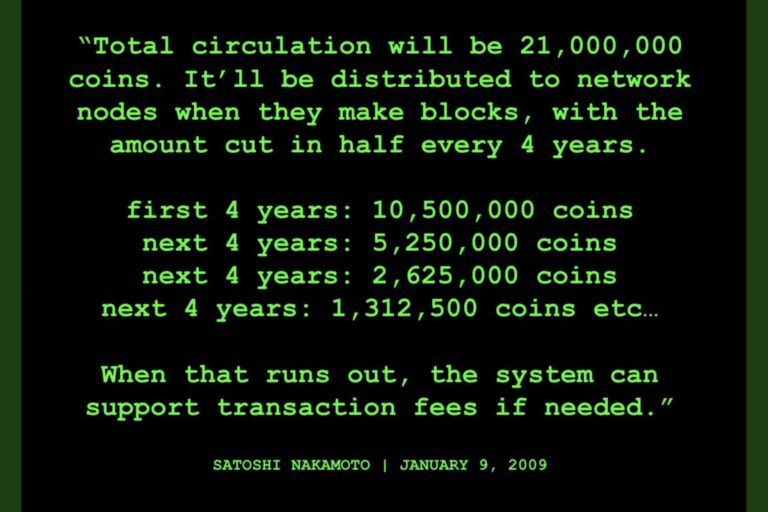

Bitcoin, on the other hand, is designed to be a deflationary currency. The total supply of bitcoins is limited to 21 million, and the supply of new bitcoins entering the market is halved every 210,000 blocks (roughly every 4 years), which helps to maintain the value of each bitcoin over time.

As a result, people who hold bitcoins can be more confident that their savings will hold their value in the long run, as opposed to being gradually eroded by inflation.

BN: Is that why bitcoiners call it number go up technology?

AI: Yes, “number go up” is a term used by some Bitcoin enthusiasts to describe the potential for the value of the cryptocurrency to appreciate over time, as a result of its scarcity and the increasing demand for it. The limited supply of bitcoins, combined with the increasing adoption of the technology, creates a situation where the price of Bitcoin could potentially increase over time, which is why some people refer to it as “number go up” technology.